Blogs

6 March 2025

Asset Beta vs. Equity Beta

When analyzing a company's risk, investors and analysts often use beta to measure its volatility relative to the market....

25 February 2025

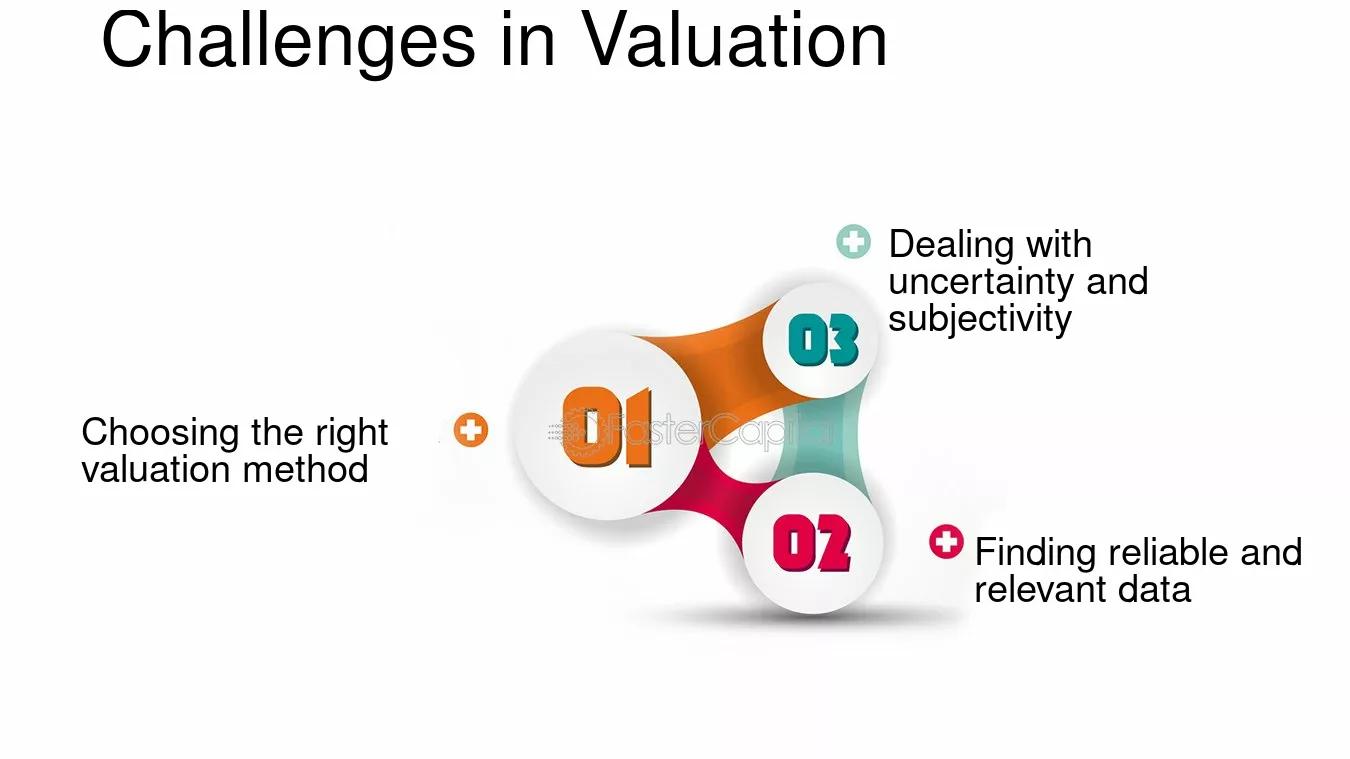

Understanding Asset Valuation and Its Impact on Your Business

Asset valuation is the process of determining the fair market value of an asset. This can be done for a variety of reaso...

18 February 2025

Valuation of Intangible Assets

In today's business world, intangible assets often hold more value than physical assets. A company's brand, patents, sof...

27 February 2025

How does the dividend discount model differ from the discounted cash flow method

The Dividend Discount Model (DDM) and Discounted Cash Flow (DCF) method are both fundamental valuation tools, but they d...

12 February 2025

Understanding Goodwill on the Balance Sheet: A Simple Guide for Investors

Goodwill is a common item on a company’s balance sheet, especially when businesses buy other companies. It shows the ext...

14 February 2025

How Valuers Drive Success in Mergers and Acquisitions

Mergers and acquisitions (M&A) are strategic business transactions that involve combining two or more companies to achie...

19 February 2025

Understanding the DCF Model

The Discounted Cash Flow (DCF) model is a financial valuation method used to estimate the value of an investment, compan...

21 January 2025

The Impact of Asset Valuation on Financial Audits: A Closer Look

Ever thought about how an organization’s asset values can significantly impact its financial audits? Asset valuation isn...

11 February 2025

How Location Shapes Real Estate Value in India

Real estate valuation is a multifaceted process that involves determining a property’s market value by analyzing several...

13 January 2025

Valuation under the Income Tax Act, 1961

Valuation is the process of determining the value of assets, transactions, or property for tax purposes. The Income Tax ...

1 January 2025

5 Basic Principles of Valuation

Future Profitability Future profitability is the only thing that determines the current value. The price should be base...

12 February 2025

Mastering Asset Valuation in Complex Indian Deals: Strategies for Accurate Assessments

In India’s rapidly growing economy, mergers, acquisitions, and strategic partnerships are common across sectors like tec...

5 March 2025

Gordon Growth Model

The Gordon Growth Model (GGM) is a simple way to value a stock based on its future dividend payments. It assumes that a ...

16 January 2025

Valuation Under the Insolvency and Bankruptcy Code (IBC), 2016: A Simplified Overview

Valuation under the Insolvency and Bankruptcy Code (IBC), 2016, plays a key role in resolving insolvency cases in India....

23 January 2025

Benchmark Valuation: A Key Tool for Investors

Investing in assets or companies can be challenging, especially when determining their true value. Benchmark valuation i...

3 February 2025

Essential Valuation Practices for Accurate Financial Reporting under IND AS

Ensuring accurate and transparent financial reporting is crucial for maintaining the confidence of investors, regulators...

7 February 2025

Comprehensive Guide to Plant and Machinery Valuation

In India's diverse industrial ecosystem, from the IT hubs of Bengaluru to the textile corridors of Coimbatore, accuratel...

29 January 2025

How to Calculate Startup Valuation: Step-by-Step Guide

Valuing a startup can seem daunting, as it involves navigating uncertainties while providing a clear financial assessmen...

20 January 2025

Valuation under the Companies Act, 2013

In the corporate world, valuation plays a crucial role in determining the fair worth of a company's assets, securities, ...

28 February 2025

How CAPM Helps You Balance Risk and Return

The Capital Asset Pricing Model (CAPM) is a cornerstone of modern finance, providing a framework to assess the relations...

13 February 2025

Business Valuations in India: Crafting the Future of Enterprises

In today’s dynamic business environment, companies in India must navigate a complex landscape of regulatory requirements...

5 February 2025

Property Valuation During Mergers & Acquisitions

Mergers and acquisitions (M&A) have emerged as powerful strategies for Indian businesses aiming to expand, diversify, or...

27 January 2025

Challenges in Turnover-Based Company Valuation and Effective Solutions

When it comes to determining the value of a company, particularly in the early stages or for small businesses, turnover-...

21 February 2025

FCFF vs FCFE: Understanding the Basics

In financial analysis, Free Cash Flow to Firm (FCFF) and Free Cash Flow to Equity (FCFE) are two crucial metrics used to...

17 February 2025

Valuation of Shares: Understanding the Process and Methods

Share valuation is a critical process in finance that involves determining the intrinsic value of a company's shares. Th...

10 January 2025

How the Business Valuation Process Works?

Business valuation refers to the method used to determine the financial value of a company. This process is essential fo...

30 January 2025

Share Valuation Techniques

Valuing a company’s shares involves estimating their intrinsic value—an assessment influenced by financial performance, ...

9 January 2025

The Importance of Business Valuation for Companies

In today's competitive business landscape, understanding the value of a company is more crucial than ever. Business valu...

6 March 2025

Why Do We Evaluate Companies?

Evaluating a company is essential for investors, business owners, and financial analysts to understand its financial hea...

6 February 2025

Cracking the Code of Inventory Valuation: A Roadmap to Financial Growth

Inventory valuation goes beyond an accounting obligation—it’s a strategic lever that shapes a business’s financial futur...

17 January 2025

Valuation Under the SEBI Act, 1992 : Why It Is Important?

The Securities and Exchange Board of India (SEBI) Act, 1992, is a crucial regulatory framework aimed at protecting the i...

20 February 2025

How Discount Rate works in DCF Model

The discount rate in a DCF model helps adjust the value of future cash flows to their present value. This is because mon...

4 February 2025

Mastering Asset and Liability Valuation

Valuing assets and liabilities accurately is at the heart of every sound financial decision. From securing investments t...

10 February 2025

Maximizing Your Startup ESOPs in India

India's startup landscape is thriving, with innovation hotspots like Bengaluru, Mumbai, and Hyderabad leading the charge...

17 January 2025

Valuation Basics: Understanding the Market Approach

Business owners often need to determine their company's worth. The market approach is a common valuation method that com...

7 January 2025

SEBI Regulations and Acquisition of Shares: A Simplified Guide

Under the SEBI Takeover Code, shares are classified based on trading volume into Frequently Traded and Infrequently Trad...

31 January 2025

Understanding Compulsory Convertible Debentures (CCDs): A Strategic Funding Approach in India

When Indian businesses seek to raise funds, they often face a critical choice: equity or debt financing. Equity dilutes ...

9 January 2025

Business Valuation: 7 Key Concepts and Terms Explained

In the fast-paced business world, understanding the value and potential of a company is crucial. Business valuation invo...

2 January 2025

Valuation Basics: The Three Valuation Approaches

Business valuation involves an in-depth qualitative and quantitative analysis of a business to determine an estimate of ...

29 January 2025

Asset Valuation: Common Mistakes and How to Avoid Them

Accurately valuing assets is key to making smart financial decisions. Whether you’re buying a business, applying for a l...

22 January 2025

Valuation of Alternative Investment Funds (AIFs)

Alternative Investment Funds (AIFs) are private pooled investment vehicles that invest in assets beyond traditional stoc...

28 January 2025

Why Valuation Analysts Matter in Business Mergers: Easy Insights and Real-Life Examples

Mergers and acquisitions (M&A) are big steps for companies. They help businesses grow, reach new markets, and stay compe...

24 January 2025

Impairment and Its Impact on EBITDA: A Simplified Overview

Understanding how impairment affects EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is essenti...

16 January 2025

Valuation under the Foreign Exchange Management Act (FEMA), 1999

FEMA, 1999, regulates foreign exchange transactions in India to maintain a balanced foreign exchange market and promote ...

6 January 2025

Top 10 Situations Where Business Valuation is Essential

Business valuation is the process of determining the worth of a business, considering factors like management, potential...

3 March 2025

EBITDA vs. Cash Flow: Differences & Why It Matters

When analyzing a company’s financial performance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortizatio...

21 January 2025

A Guide to Security Valuation: Understanding the True Worth of Your Investments

Imagine you're looking to buy a new car. Would you make the purchase without understanding its true value? Of course not...

4 March 2025

Key Financial Ratios and Their Interpretation

Financial ratios help investors, analysts, and business owners assess a company’s financial health, profitability, and e...

24 February 2025

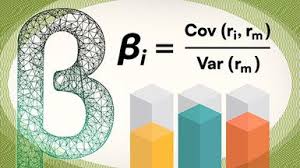

Understanding Beta in the CAPM Model

In finance, beta (β) is a cornerstone concept within the Capital Asset Pricing Model (CAPM) that quantifies an asset’s s...

15 January 2025

Key Share Valuation Methods for M&A and Investment Decisions

When engaging in mergers, acquisitions, or investments, one of the most critical steps is determining the value of a com...